The information contained herein is for informational or educational purposes only.

Find the right online bank account for your savings strategy.

Chances are, you have a regular savings account — a safe place to store your cash for emergencies, a down payment or that dream vacation. But are you getting the most from the money sitting in your account?

USA Today estimates that more than 20% of Americans don’t know what interest rate they’re earning on their savings accounts. And many of the ones who do know are not taking advantage of the earning opportunities available in the current high-interest rate environment (at time of publication).

You have more ways now than ever before to take charge of your financial future and define a strategy including options with the perks of a traditional savings account, plus higher yields and new ways to get rewarded.

Let’s evaluate three options and find the best one for you. First, answer this question: Which one of these statements best describes your personal financial strategy?

I want my savings to be a money maker and I’m comfortable holding it in my account for a designated period of time.

In today’s high-yield environment, certificates of deposit (CDs) are a smart option if you don’t need to spend your cash right away and want to optimize its earning potential, but most CDs will require a minimum funding deposit amount.

Unlike a traditional savings account, when you open a CD, you’re expected to leave your money in place for a specific time period, or “term” — anywhere from six months to a year or longer. Once your CD matures (meaning it’s reached the end of its term), your earned interest is added to your account balance — and, just like that, you’ve made money without lifting a finger.

The biggest benefit of a CD account is that you’re able to lock in an attractive annual percentage yield (APY) when you open your account, so you’ll know just how much interest you’ll earn once your CD matures.

The biggest drawback of a CD is that your money is tied up for the length of your term. If you withdraw your cash early, chances are you’ll incur penalties and lose some earned interest, which negates the benefits of opening a CD in the first place. This makes CDs best suited for people who are comfortable parking their money and don’t need their savings to act as an emergency fund.

APYs are subject to change at any time, so be sure to shop around before opening a CD account. At Bask Bank, our CDs offer a competitive interest rate in the market.

I want to earn interest without limiting my access to cash.

If you like the earning potential of a CD but are hesitant to commit to a fixed term because you might need to access your cash, then a high-yield savings account could be a better option.

This type of savings account offers APYs that are close to par with CDs but without withdrawal penalties. A high-yield savings account offers the same level of liquidity as a traditional savings account, so you can easily access cash when you need it — making it ideal for managing life’s unexpected expenses.

Recently, the popularity of high-yield accounts has increased as more digital banks offer high-yield products with APYs significantly higher than traditional savings accounts. If you’re considering opening a high-yield savings account, consider a Bask Interest Savings Account — and make sure to check out the reviews from real Bask customers.

I want to earn airline miles.

A savings account that earns travel rewards, like the Bask Mileage Savings Account, could be your best option.

Unlike CDs or high-yield savings accounts that earn cash, this account earns American Airlines AAdvantage® miles that can be redeemed for travel at American Airlines or any of its 20-plus travel partners, including members of its Oneworld® travel alliance. For every $1 saved annually, you’ll earn 1.75 miles, which can quickly add up and put you one step closer to booking your next travel adventure.

Like a traditional savings account, money can be withdrawn at any time without penalties. It’s the perfect savings option for anyone with big travel plans on the horizon, like a honeymoon, anniversary trip or family getaway. Plus, you can use miles for more than just flights. You can use them for hotels, rental cars and entertainment, too.

I want to maximize my savings and use multiple options.

When it comes to your personal financial strategy, there’s more than one way to optimize your money’s earning potential. Consider using a blended approach by opening multiple online savings accounts.

Start with a high-yield savings account and use it as your high-performing, rainy-day fund. The more deposits you make, the more interest you’ll earn for all of life’s purchases. Then add a CD with a term that best addresses your longer-term savings needs, like a down payment on a car or house if you’re waiting for the ideal timing. Then start planning for that dream vacation by opening a mileage savings account.

Now is the time to explore all your online savings account options and maximize the power of your money.

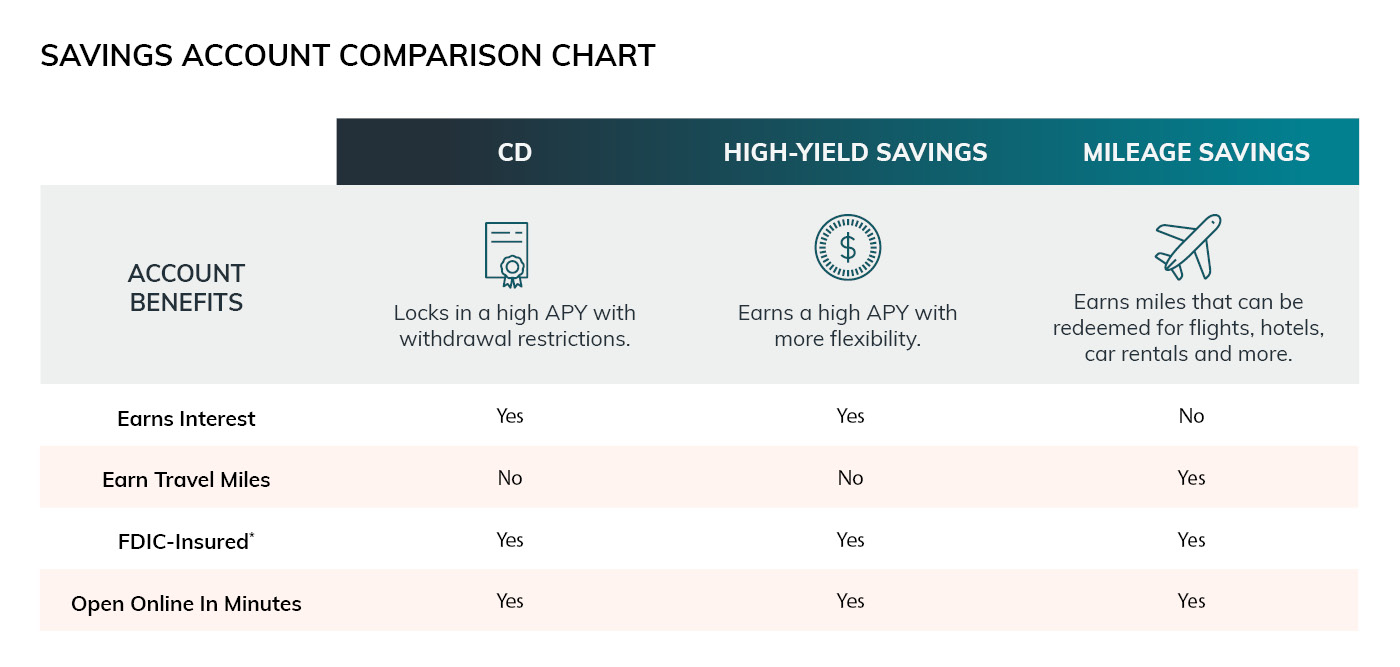

CD | hIGH-yIELD sAVINGS | mILEAGE sAVINGS | |

|---|---|---|---|

aCCOUNT bENEFITS | Locks in a high APY with withdrawal restrictions. | Earns a high APY with more flexibility. | Earns miles that can be redeemed for flights, hotels, car rentals and more |

Earns Interest | Yes | Yes | No |

Earns Travel Miles | No | No | Yes |

Fdic-Insured* | Yes | Yes | Yes |

Open Online in Minutes | Yes | Yes | No |

*The sum of your deposits with Bask Bank and Texas Capital Bank is insured to at least $250,000 per depositor for each account ownership category.

CD | hIGH-yIELD sAVINGS | mILEAGE sAVINGS | |

|---|---|---|---|

aCCOUNT bENEFITS | Locks in a high APY with withdrawal restrictions. | Earns a high APY with more flexibility. | Earns miles that can be redeemed for flights, hotels, car rentals and more |

Earns Interest | Yes | Yes | No |

Earns Travel Miles | No | No | Yes |

Fdic-Insured* | Yes | Yes | Yes |

Open Online in Minutes | Yes | Yes | No |

*The sum of your deposits with Bask Bank and Texas Capital Bank is insured to at least $250,000 per depositor for each account ownership category.

The Bask Blog

5 Ways You Can Keep Your Bank Account Safe

Take these steps to further increase your digital banking security, keep your bank account safe online and avoid fraud.

Interest Rate vs. APY: What's the Difference?

Interest rate and APY are often used interchangeably, but what exactly do they mean? And what’s the real difference between the two?

Understanding Digital Wallets

A digital wallet, or e-wallet, is an app that securely stores credit and debit cards on your mobile device. Learn more about digital wallets from Bask Bank.